Big data has radically changed the accounting profession. Accountants are using new software with sophisticated machine learning algorithms to better address the nuances of their situations. They are also using more advanced data analytics tools to make more meaningful insights into the nature of their clients’ financial matters. Cloud technology has also helped accountants.

The lease accounting profession has been particularly influenced by advances in big data. There are a lot of data-driven software applications that are designed specifically for lease accountants.

The Use of Big Data Software in Lease Accounting

Lease accounting demands accuracy and timeliness. A vague, cluttered approach to it — especially in terms of the ASC 842 standards — only invites costly accounting mistakes and poor audit trails. These can undoubtedly wreck your regulatory compliance, decision-making abilities, and financial performance when managing your leases.

That is why you can’t stick to using spreadsheets and manual lease accounting workflows. You need robust software solutions with complex machine learning and data analytics algorithms to systematize, simplify, and standardize them for more precise, compliant reports. This is just one of the many examples of using data analytics in financial planning.

If you’re looking for this kind of tool to use for your business, check out these top five data-driven lease accounting software solutions:

1. Trullion

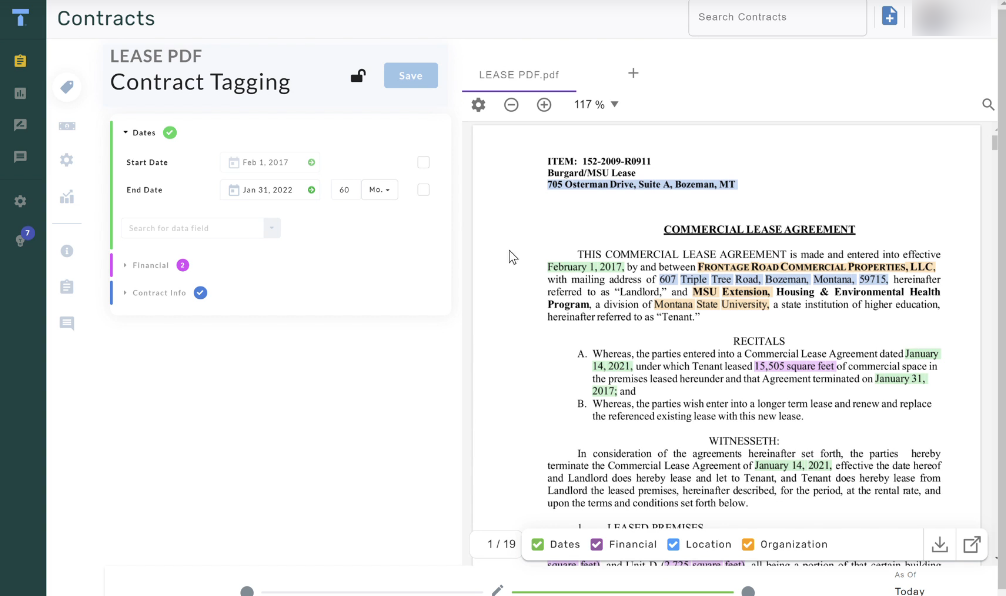

Trullion is a SaaS platform that empowers companies to comply with various essential accounting standards for their leases. Trullion does this through different robust streamlining functionalities.

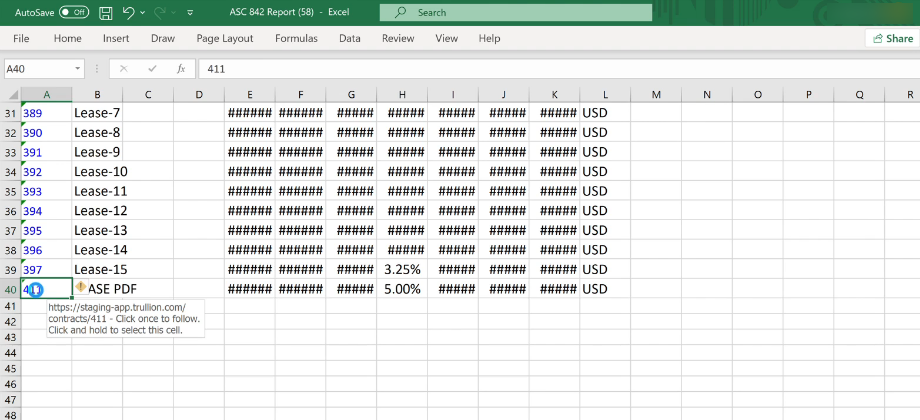

For one, it has automated data entry capabilities powered by artificial intelligence (AI) and optical character recognition (OCR). Trullion can read and extract critical information from PDF contracts with top-notch accuracy rates in a few minutes only. Once your documents are up on the platform, you’re ready to go. It can even detect asset-related Excel data.

This function is beneficial for accounting firms, asset-heavy projects, and mergers and acquisitions. Trullion even enables managers to authorize tagging functions and supports several authorization rounds.

Trullion also automates your IFRS 16, ASC 842, and GASB 87 workflows into completely auditable disclosures and journal entries that remain connected to their data sources.

This means you can go from financial entries on Excel straight to the original contract on Trullion for your immediate reference. That feature makes the platform ideal for chief financial officers, controllers, and auditors.

Additionally, Trullion offers visual, intuitive, and straightforward dashboard functionalities to ease their daily tasks and reports. A well-rounded platform, Trullion keeps your leases in one place with automatic analyses.

With a convenient time-saver like Trullion, regulatory compliance and audit trails become a breeze for accounting leaders — significantly skyrocketing their efficiency and productivity.

2. LeaseQuery

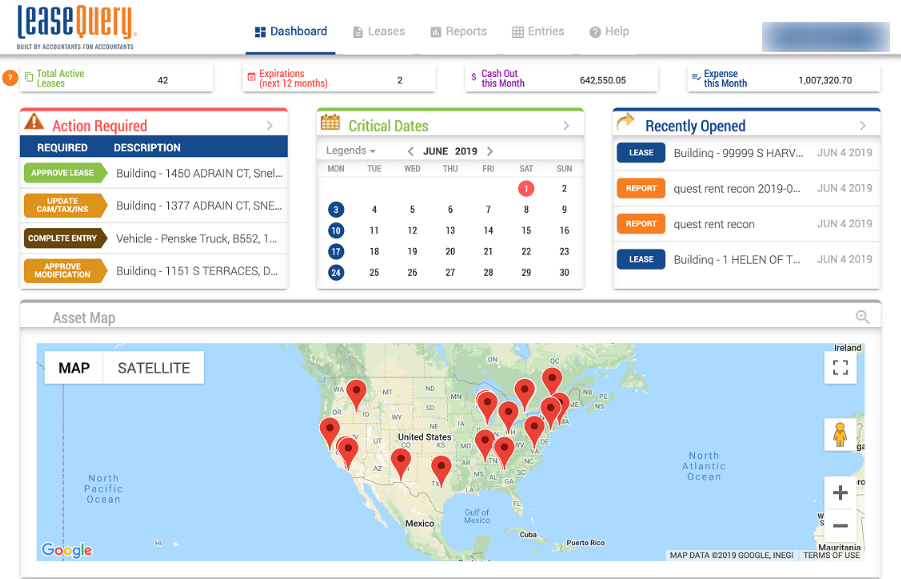

LeaseQuery is a high-quality software tool that also adheres to mandatory lease accounting standards. It helps accountants avoid committing financial reporting mistakes through automation and CPA-approved IT strategies.

LeaseQuery is versatile, with abilities to manage equipment and real estate leases. It can quickly identify the implications of new accounting rules on your company’s lease portfolio, plus create precise lease postings for you.

The platform even provides seamless integration with any enterprise resource planning (ERP) software. Additionally, it has free accounting templates, calculators, and other useful tools.

LesseQuery’s other functionalities include:

- Capitalization reporting

- Budgeting and forecasting

- Amortization schedule, and others.

However, LeaseQuery lacks some would-be-helpful features. For instance: recommendations for developing some procedures and policies, internal controls on functionality, and other essential matters auditors want to understand more deeply.

Moreover, some reports entail much effort to create. This is disadvantageous if your organization relies substantially on reports to determine your right-of-use assets and lease liability.

3. Lease Accelerator

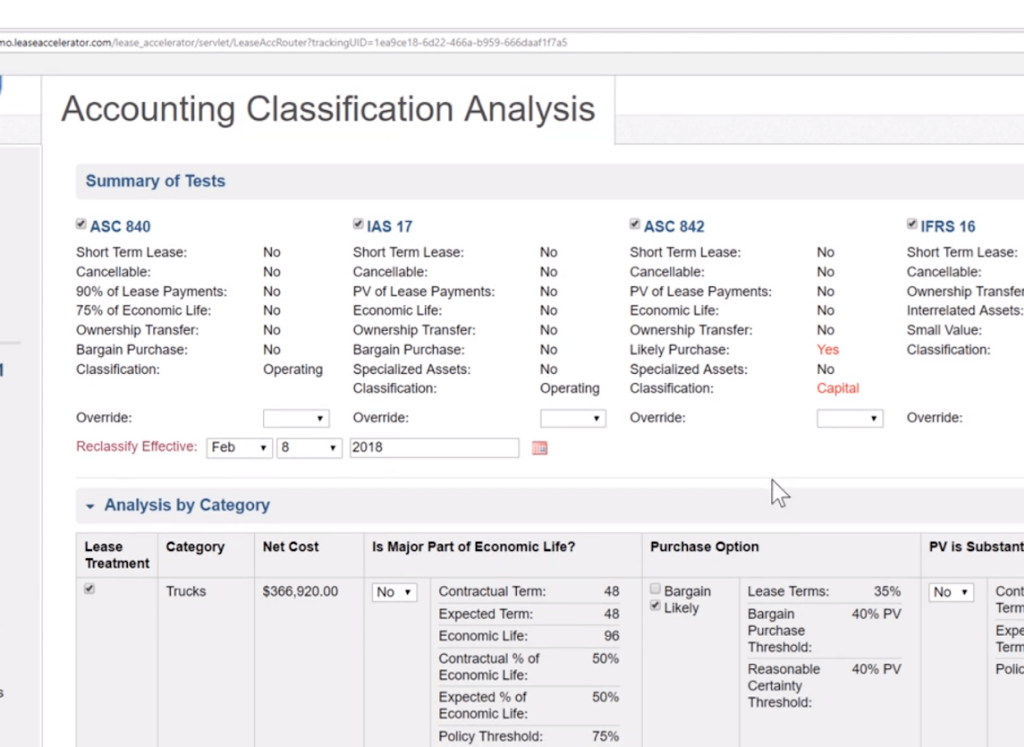

Lease Accelerator is an enterprise lease accounting solution ensuring your compliance to various standards. It is chock-full of life cycle automation features — from commencement to data management, accounting and reporting, and end-term supervision.

For more efficient closing processes, its specialized sub-ledger provides trial balance, push-button disclosures, cause of change reports, and roll-forward features.

It also helps you maintain compliance by integrating accounting standards and corporate policies into the system and centralized asset-level data. The latter function helps you monitor any adjustments in your leasing portfolio.

Lease Accelerator also works smoothly with ERP solutions for real estate, equipment leases, and others. This makes lease data management seamless and your monthly closes accurate and complete.

Lease Accelerator, though, is expensive and can be financially challenging, especially for startups and small businesses. You will also need rigorous software training because of its exhaustive function suite. This translates to possibilities of long onboarding times and steep learning curves.

4. Visual Lease

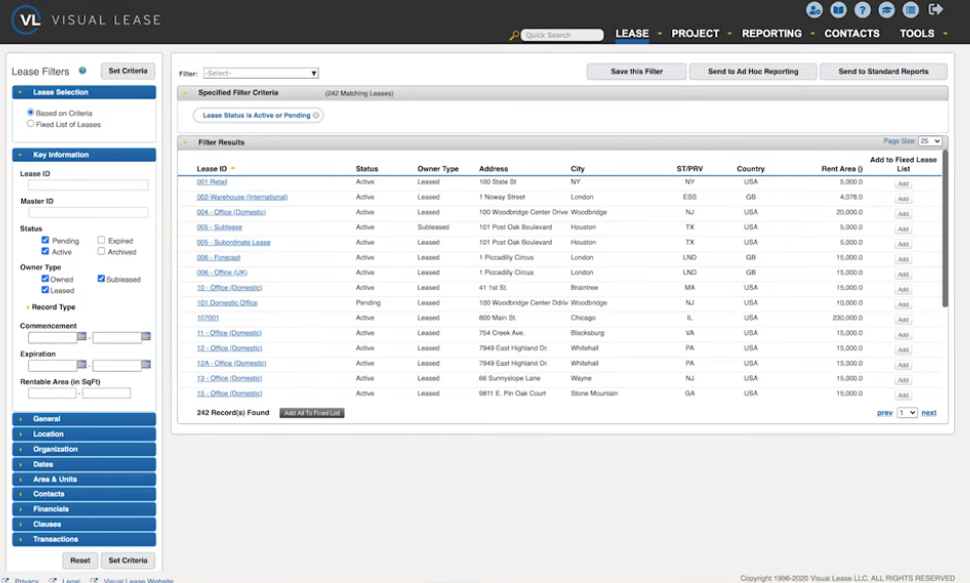

If you’re looking for a cloud-based facility management solution integrating lease administration and lease accounting, use Visual Lease.

Its features include an amortization schedule, contact and portfolio management, classification finance and operating leases, critical data alerts, and others similar to LeaseQuery.

This SaaS platform also works flexibly with many third-party applications and offers a centralized place for your leases. With its streamlined workflows, hundreds of automated report templates, and comprehensive internal controls, companies can be audit-ready throughout the year.

Despite these helpful features, Visual Lease has some downsides, such as mapping inaccuracies requiring manual interventions and complicated ad hoc report set-ups.

Its functionality for data retrieval from reports also needs improvement. For example, input keys (particularly for dates) sometimes malfunction, requiring repetitive retyping until you get the correct entry.

You can even encounter challenges concerning contract terminations and disposals and life cycle management of a leased asset. This is crucial since it influences your accounting and compliance with new lease standards.

5. Costar Group

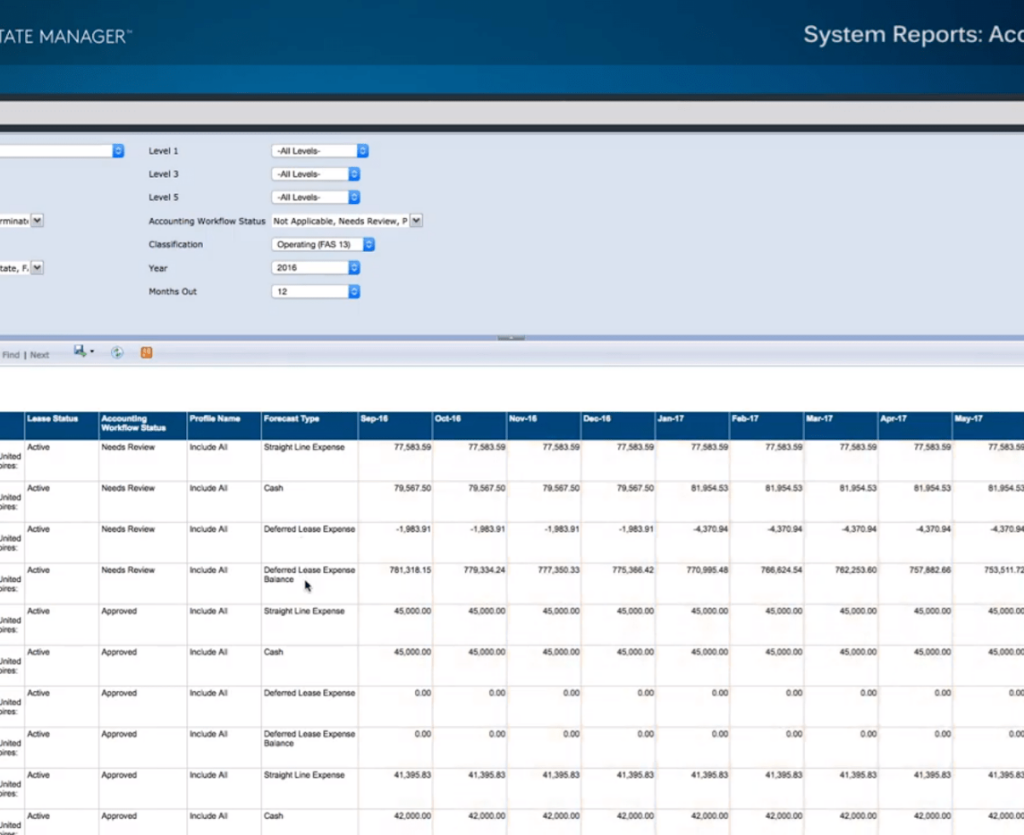

CoStar Real Estate Manager is an accounting software that supports your real estate and equipment lease accounting workflows. It streamlines your lease administration for owned properties, sub-leased tenants, and leased locations. Its functions best suit corporate real estate departments, equipment lease managers, retailers, service providers, and restaurants.

CoStar’s capabilities include the following:

- Automated disclosure plus roll-forward reporting with audit notes

- Accounting dashboard with live balance sheet impact

- Automatic journal entry posting to the general ledger, etc.

Moreover, CoStar can analyze and classify leases for new agreements. You can automatically process taxes and compute percentage rental obligations. It also empowers you to make intelligent business decisions by leveraging lease and real estate information.

With these extensive features, CoStar is a one-stop-shop for industry-relevant businesses.

Unfortunately, CoStar’s navigation is complicated. It does not provide software training, so you have to explore and study the functions yourself. If you previously used a different solution, you’ll struggle with this tool.

CoStar is also not cost-effective. It has an expensive price tag considering its arduous functionality, the numbers of tools available, and the lack of unique listing information you can’t find anywhere else. The demo and paid product versions also entail long bureaucratic steps.

Choose the best lease accounting software for your business

Lease accounting is a business-critical aspect you can’t afford to compromise. These leading software solutions can help you do just that — implementing compliant practices, monitoring lease transactions correctly, and creating timely, accurate reports.

Although they offer similar features, they have particular distinctions that make one solution superior to another. Take time to explore, discover, and select the one that works best for your dynamics, makes you audit-readiest, and streamlines workflows the greatest.

The post Top 5 Data-Driven Lease Accounting Software Solutions appeared first on SmartData Collective.

0 Commentaires