Investors are warning of a domino effect following the bankruptcy of Silicon Valley Bank (SVB) on Friday, that could affect the startup scene and other banks.

Silicon Valley Banks stock was in freefall on Thursday and Friday, plunging over 80% and wiping $55 billion USD from Wall Street's top 4 banks in a single market day. JPMorgan lost $22 billion USD on the day, making it the bank with the largest loss. Fears of contagion effects from financial distress at Silicon Valley Bank fueled the selloff.

The situation was weighing on all stocks, but especially on financial stocks. SVB stock trading was suspended on Friday as regulators took over. The FDIC, Federal Deposit Insurance Corporation, was appointed as receiver, which the California Department of Financial Protection and Innovation (DFPI) announced on Friday. Reasons for regulatory measures were insufficient liquidity and insolvency.

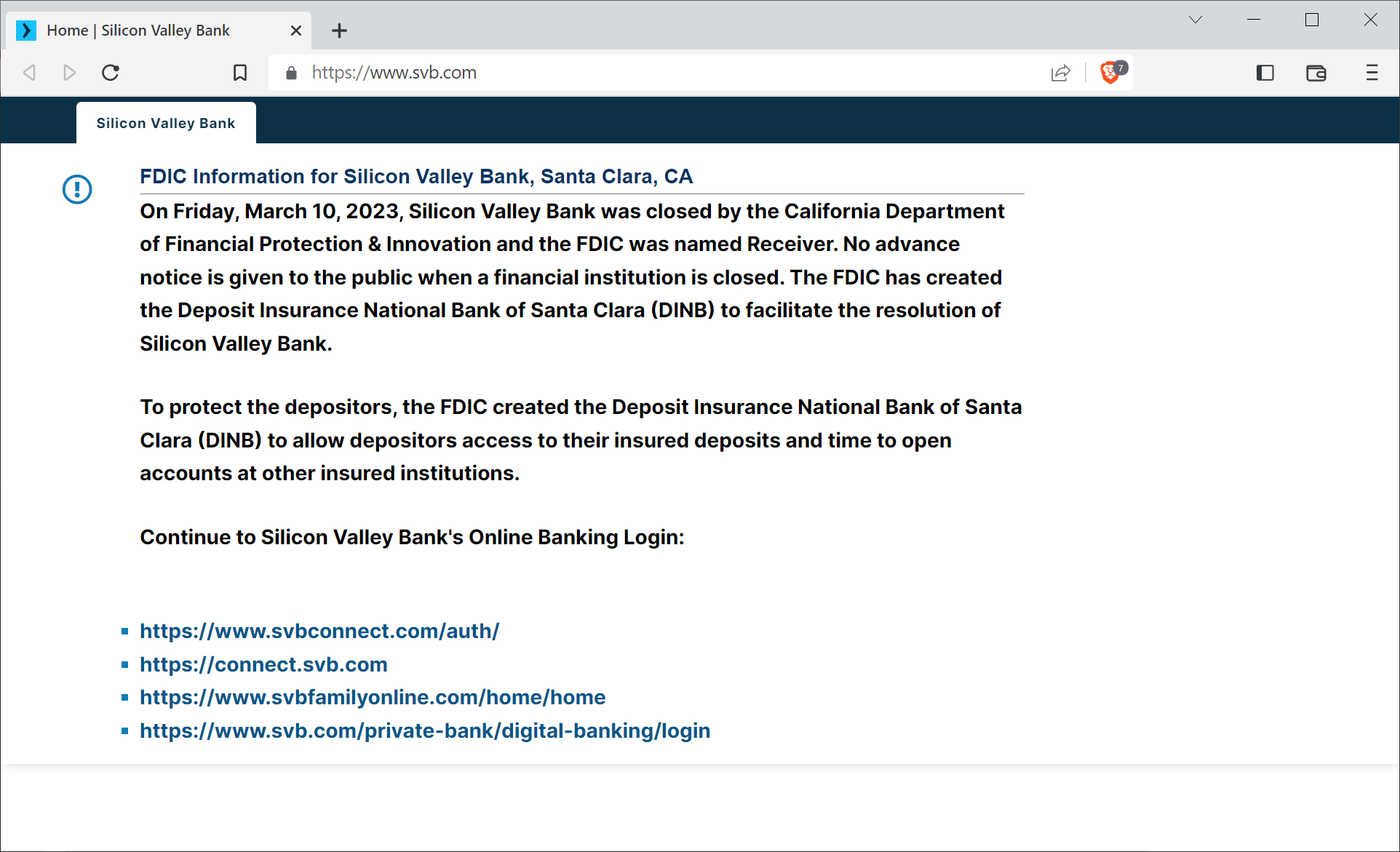

Customers who visit the SVB website are informed that the bank was closed by the California Department of Financial Protection & Innovation.

SVB was the 16th largest bank in the United States. The California Department of Financial Protection and Innovation notes that the bank had total assets of "approximately $209 billion" and total deposits of "approximately $175.4 billion" on December 31, 2022.

It is the biggest bankruptcy in the sector since 2008, when the United States' largest savings and loan association, Washington Mutual, collapsed.

What made matters worse was that crypto bank Silvergate announced on Thursday that it would write off its assets and wind down its business. The week before, Silvergate warned that it was evaluating whether it could stay in business. The company faced several problems, including a pending US Department of Justice investigation.

Silvergate, one of the United States largest crypto-focused banks, faced industry and regulatory developments, which included the collapse of FTX in November 2022 and interest rates hikes by the Federal Reserve to combat inflation.

Silicon Valley Bank and startups

One of Silicon Valley Bank's core lines of business was to provide financing for startups, venture capitalists and companies in the technology sector. Fears are growing that Silicon Valley Bank will take lots of startups down with it.

Techcrunch, for example, reports that 60 YC-backed Indian startups have "more than $250,000 stuck in accounts with Silicon Valley Bank and nearly two dozen have more than $1 million tied with the lender". Garry Tan, Y Combinator's new President and CEO, told CNBC that he estimates that about 1000 startups are affected by the bank's collapse. About a third of them could face an existential crisis if they don't manage to secure additional financing.

Research done by The Kobeissi Letter (TKL), which describes itself as "an industry leading commentary on the global capital markets", claims that SVB has "nearly $200 billion in deposits" and that "97% of those deposits [are] above the $250,000 FDIC limit". TKL lists Circle, Roku, BlockFi, Roblox, and Ginko Bi as bank customers.

FDIC is a United States government corporation that supplies deposit insurance to "depositors in American commercial banks and saving banks". The FDIC insures deposits up to $250,000 per ownership category. Startups who have deposited more than $250,000 face uncertainty, as it is not clear if they will receive their money back in full, partially, or only to the insured amount. Reuters reports that 89% of the bank's $175 billion in deposits were uninsured.

Bloomberg notes that the FDIC could liquidate between 30% to 50% of unsecured bank deposits as early as Monday, which it would then use to make advanced payments to owners of unsecured deposits.

The FDIC will try and liquidate SVB, and service claims above the statutory deposit insurances using the proceeds. No bank or buyer has expressed interest in buying SVB yet, but some of the larger banks and financial organizations could consider a full takeover or at least the purchase of specific assets.

Update: on Sunday, the United States announced several emergency measures to strengthen confidence in the banking system. United States regulators said on Sunday that customers will "have access to all their deposits starting Monday", according to Reuters. A new emergency fund is available for banks as well, which may be used "to borrow from it in emergencies".

The decisive action has had a positive effect on U.S. S&P 500 stock futures and Nasdaq futures, which were both up more than 1% after trading started in Asia.

Closing Words

Market Insider notes that the collapse of the SVB is just the latest casualty of rapidly changing market conditions. Rising interest rates and a rising attractiveness of less risky investments, is causing money shifts from "high-growth tech stocks, crypto, and privately held start-ups".

Startups will experience this shift in several ways. The securing of financing may become more difficult, as investors may prefer low-risk investments, especially if interest rates continue to increase in the coming weeks and months in many regions of the world.

For new startups, the situation is also becoming worse. They may have difficulties securing additional financing because of increasing fears that the tech boom is slowing down and that more bankruptcies are on the horizon.

The swift actions carried out by the United States government have bolstered confidence. The situation itself is still convoluted, especially for customers of SVB bank.

Thank you for being a Ghacks reader. The post Startup bankruptcies feared after Silicon Valley bank collapses appeared first on gHacks Technology News.

0 Commentaires